Business Meal Expense Deduction 2024 – Taking advantage of these often overlooked tax deductions can help you lower your tax bill. . Taxpayers who itemize their deductions can instead write off expenses such as mortgage For the 2023 tax year, deductions for business-related meals and beverages from restaurants are back .

Business Meal Expense Deduction 2024

Source : ledgergurus.comCheck, Please: Deductions for Business Meals and Entertainment

Source : www.ellinandtucker.comDeducting Meals as a Business Expense

Source : www.thebalancemoney.comMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.co100% Deduction for Business Meals in 2021 and 2022 Alloy Silverstein

Source : alloysilverstein.com2024 Guide to Meal and Lodging Expenses In The US Driversnote

Source : www.driversnote.comExpanded meals and entertainment expense rules allow for increased

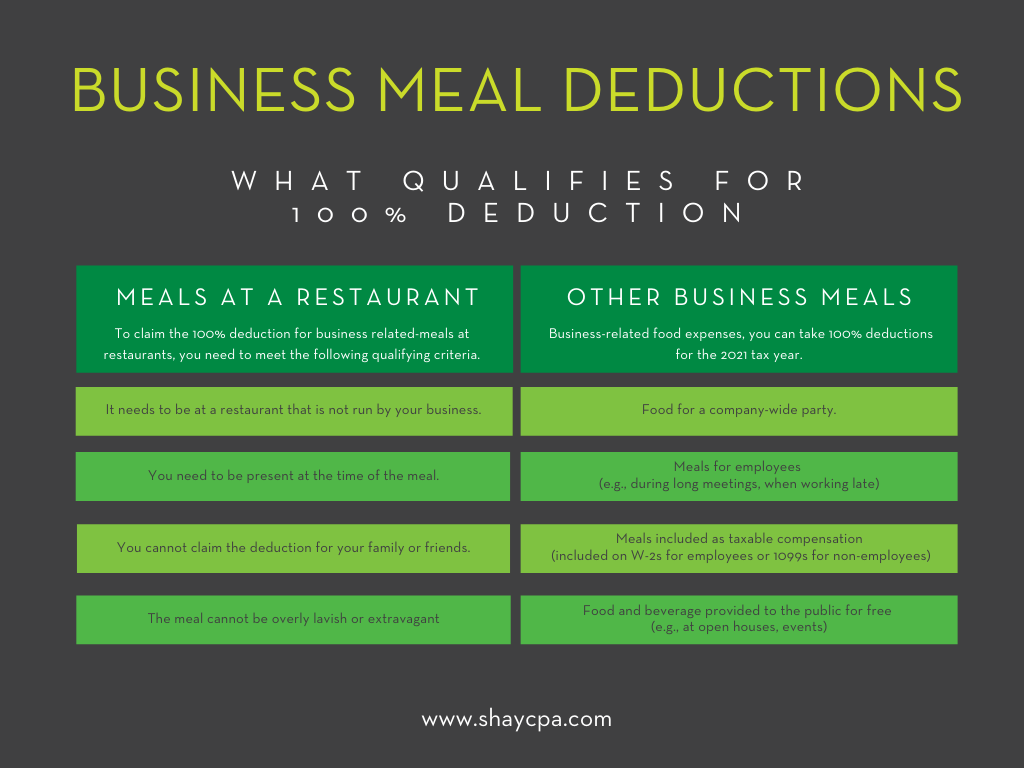

Source : www.plantemoran.comMeals and Entertainment Deduction Shay CPA

Source : shaycpa.comBusiness Meal Expense Deduction 2024 Meal and Entertainment Deductions for 2023 2024: “These types of use cases for expenses are officially gone.” Businesses can still deduct 50 percent of the cost of qualifying business meals, as long as you or someone from the business are . Mileage or vehicle expenses. Retirement savings. Insurance premiums. Office supplies. Home office expenses. Credit card and loan interest. Phone and internet costs. Business meals. Business .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)

.svg)