Business Use Of Home 2024 – By using a part of your home exclusively for work, you may qualify for certain tax deductions, such as a prorated part of your rent. To deduct the business use of a home, you must use a portion of . The home office deduction is a tax break for self-employed people who use part of their home for business activities. Here’s how it works. Many or all of the products featured here are from our .

Business Use Of Home 2024

Source : blog.taxdome.com2024 HOT] 4.2 Cu ft Large Home Safe Fireproof Waterproof with

Source : www.amazon.comBuy OfficeSuite Home and Business 2024 Transferable | Digital

Source : www.licencedeals.comAmazon.com: Office Suite 2024 Pack Compatible with Microsoft

Source : www.amazon.comBest Ink Tank Printer 2024 (For Home Use & Small Business) YouTube

Source : www.youtube.comAmazon.: 2024 Desk Calendar The Office Desk Calendar Office

Source : www.amazon.comHome

Source : business.defense.govBeginner’s Guide To Selling On eBay (2024 Edition): How To Start

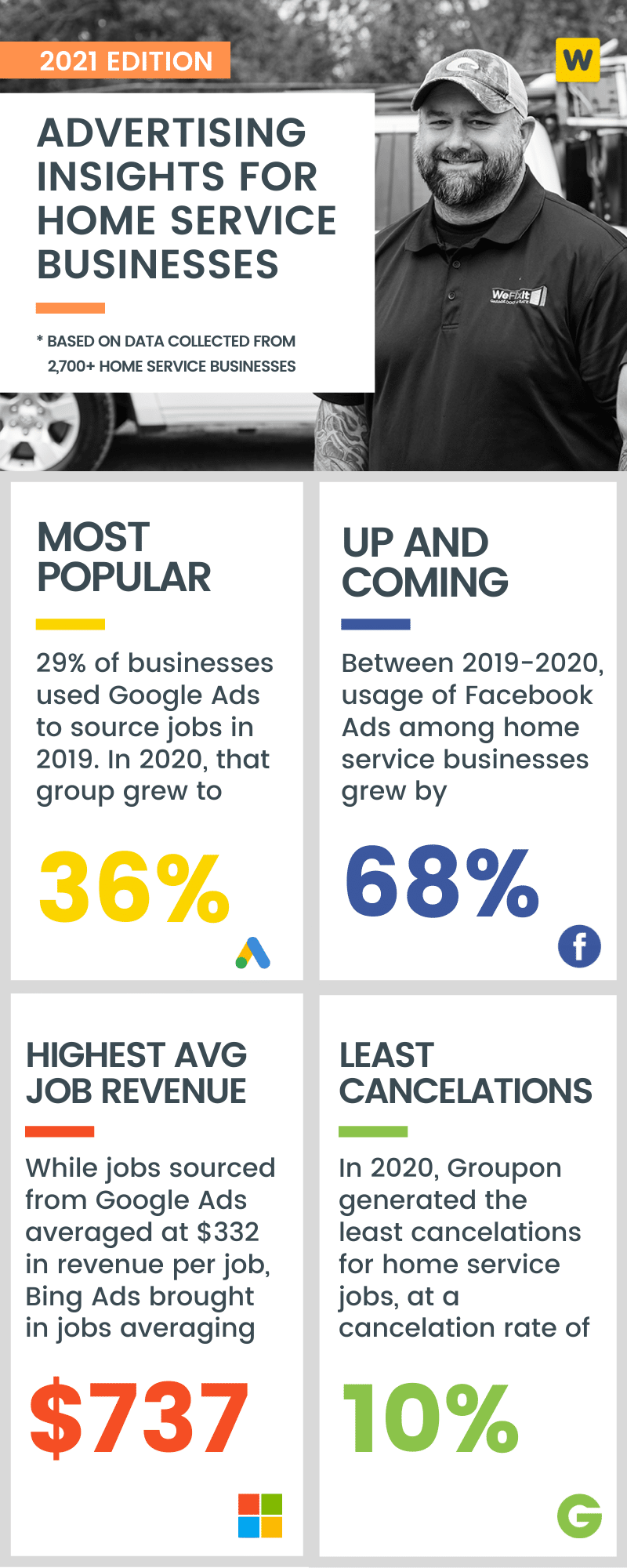

Source : www.amazon.comHome Service Business Advertising: Insights for 2024 Workiz

Source : www.workiz.com2024 HOT] 4.2 Cu ft Large Home Safe Fireproof Waterproof with

Source : www.amazon.comBusiness Use Of Home 2024 How to Start a Tax Preparation Business from Home: 2024 : How do I calculate the percentage of my home used for business? Using Form 8829, Expenses for Home Business Use, you can calculate the percentage of business use of your home by following these steps. . Whether you’re looking to replace your income from a nine-to-five job or would like some extra spending money, you don’t have to leave your home to do so. Fortunately, there is no shortage of .

]]>